- 98.50 KB

- 2022-04-29 14:20:32 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

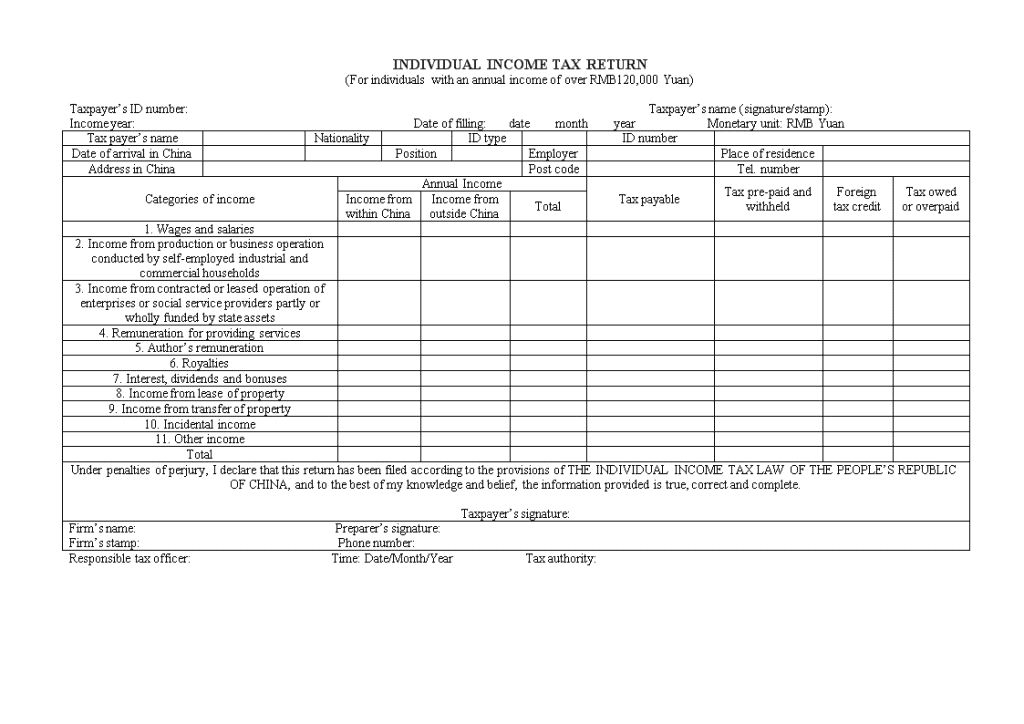

'INDIVIDUALINCOMETAXRETURN(ForindividualswithanannualincomeofoverRMB120,000Yuan)Taxpayer’sIDnumber:Taxpayer’sname(signature/stamp):Incomeyear:Dateoffilling:datemonthyearMonetaryunit:RMBYuanTaxpayer’snameNationalityIDtypeIDnumberDateofarrivalinChinaPositionEmployerPlaceofresidenceAddressinChinaPostcodeTel.numberCategoriesofincomeAnnualIncomeTaxpayableTaxpre-paidandwithheldForeigntaxcreditTaxowedoroverpaidIncomefromwithinChinaIncomefromoutsideChinaTotal1.Wagesandsalaries2.Incomefromproductionorbusinessoperationconductedbyself-employedindustrialandcommercialhouseholds3.Incomefromcontractedorleasedoperationofenterprisesorsocialserviceproviderspartlyorwhollyfundedbystateassets4.Remunerationforprovidingservices5.Author’sremuneration6.Royalties7.Interest,dividendsandbonuses8.Incomefromleaseofproperty9.Incomefromtransferofproperty10.Incidentalincome11.OtherincomeTotalUnderpenaltiesofperjury,IdeclarethatthisreturnhasbeenfiledaccordingtotheprovisionsofTHEINDIVIDUALINCOMETAXLAWOFTHEPEOPLE’SREPUBLICOFCHINA,andtothebestofmyknowledgeandbelief,theinformationprovidedistrue,correctandcomplete.Taxpayer’ssignature:Firm’sname:Preparer’ssignature:Firm’sstamp:Phonenumber:Responsibletaxofficer:Time:Date/Month/YearTaxauthority:

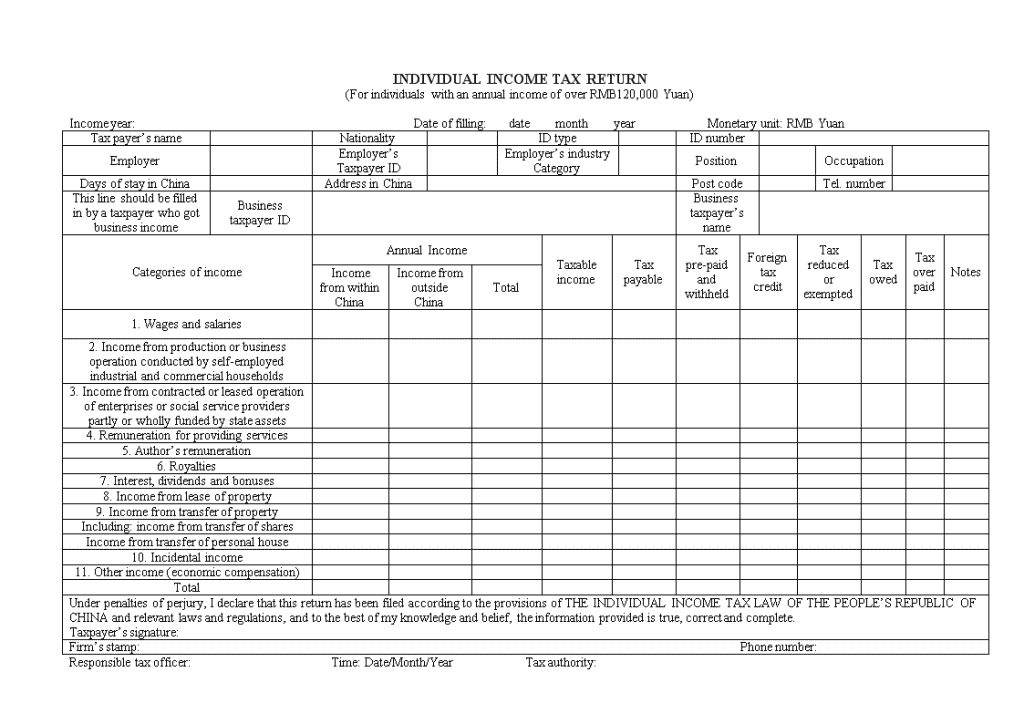

INDIVIDUALINCOMETAXRETURN(ForindividualswithanannualincomeofoverRMB120,000Yuan)Incomeyear:Dateoffilling:datemonthyearMonetaryunit:RMBYuanTaxpayer’snameNationalityIDtypeIDnumberEmployerEmployer’sTaxpayerIDEmployer’sindustryCategoryPositionOccupationDaysofstayinChinaAddressinChinaPostcodeTel.numberThislineshouldbefilledinbyataxpayerwhogotbusinessincomeBusinesstaxpayerIDBusinesstaxpayer’snameCategoriesofincomeAnnualIncomeTaxableincomeTaxpayableTaxpre-paidandwithheldForeigntaxcreditTaxreducedorexemptedTaxowedTaxoverpaidNotesIncomefromwithinChinaIncomefromoutsideChinaTotal1.Wagesandsalaries2.Incomefromproductionorbusinessoperationconductedbyself-employedindustrialandcommercialhouseholds3.Incomefromcontractedorleasedoperationofenterprisesorsocialserviceproviderspartlyorwhollyfundedbystateassets4.Remunerationforprovidingservices5.Author’sremuneration6.Royalties7.Interest,dividendsandbonuses8.Incomefromleaseofproperty9.IncomefromtransferofpropertyIncluding:incomefromtransferofsharesIncomefromtransferofpersonalhouse10.Incidentalincome11.Otherincome(economiccompensation)TotalUnderpenaltiesofperjury,IdeclarethatthisreturnhasbeenfiledaccordingtotheprovisionsofTHEINDIVIDUALINCOMETAXLAWOFTHEPEOPLE’SREPUBLICOFCHINAandrelevantlawsandregulations,andtothebestofmyknowledgeandbelief,theinformationprovidedistrue,correctandcomplete.Taxpayer’ssignature:Firm’sstamp:Phonenumber:Responsibletaxofficer:Time:Date/Month/YearTaxauthority:'

您可能关注的文档

- 在我市启用新纳税申报表工作会议结束时的总结

- 个人所得税纳税申报表

- 权益法下长期股权投资财税差异及纳税申报表的填写

- 生产、经营所得个人所得税纳税申报表(B表)

- 《中华人民共和国企业所得税年度纳税申报表(A …

- 《中华人民共和国企业所得税年度纳税申报表(A …

- 耕地占用税纳税申报表

- A06121《车辆购置税纳税申报表》

- 增值税纳税申报表

- 广东省地方税收纳税申报表

- 新企业所得税年度纳税申报表看法思考

- 房产税纳税申报表

- 印花税纳税申报表

- 【实用财税图书】《企业所得税汇算清缴实务之年度纳税申报表项目解析与填报实务》(2018年版)(含表单

- 2014年企业所得税汇算清缴新政解读与新纳税申报表填报技巧

- 企业所得税年度纳税申报表(a类,2014年版)培训

- 增值税纳税申报表填表说明

- 新《企业所得税纳税申报表》辅导讲义