- 57.50 KB

- 2022-04-29 14:22:22 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

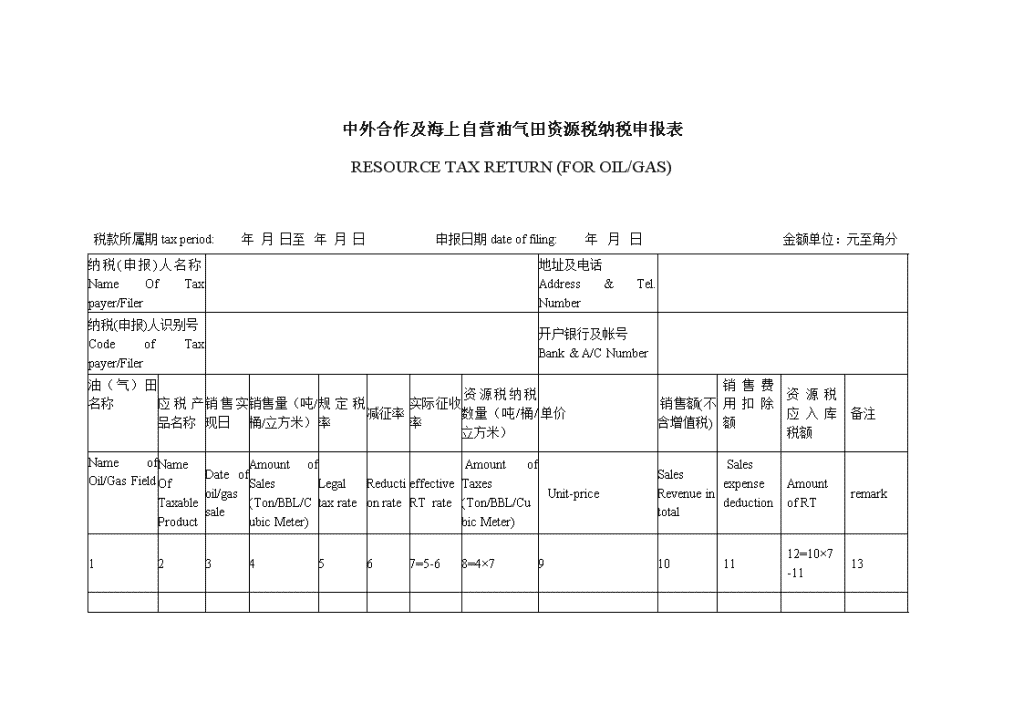

'中外合作及海上自营油气田资源税纳税申报表RESOURCETAXRETURN(FOROIL/GAS)税款所属期taxperiod: 年月日至 年月日申报日期dateoffiling: 年 月 日金额单位:元至角分纳税(申报)人名称NameOfTaxpayer/Filer 地址及电话Address&Tel.Number 纳税(申报)人识别号CodeofTaxpayer/Filer 开户银行及帐号Bank&A/CNumber 油(气)田名称应税产品名称销售实现日销售量(吨/桶/立方米)规定税率减征率实际征收率 资源税纳税数量(吨/桶/立方米) 单价 销售额(不含增值税)销售费用扣除额 资源税应入库税额备注NameofOil/GasFieldNameOfTaxableProductDateofoil/gassaleAmountofSales(Ton/BBL/CubicMeter)LegaltaxrateReductionrateeffectiveRT rate AmountofTaxes(Ton/BBL/CubicMeter) Unit-priceSalesRevenueintotal Salesexpensededuction AmountofRTremark1234567=5-68=4×7910 11 12=10×7-1113

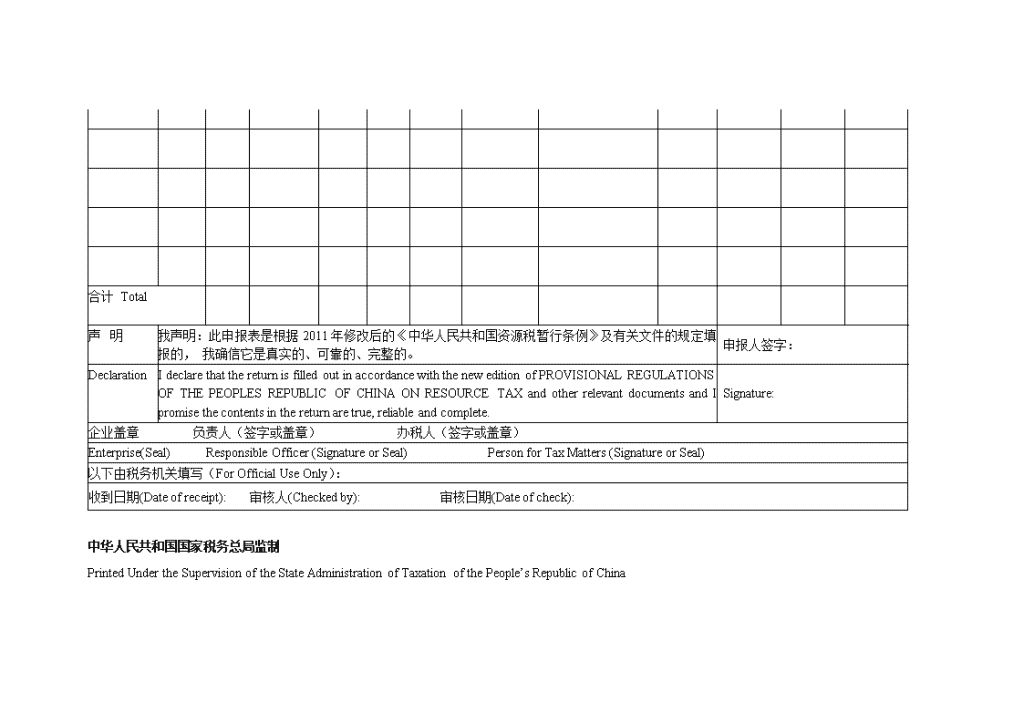

合计Total 声 明我声明:此申报表是根据2011年修改后的《中华人民共和国资源税暂行条例》及有关文件的规定填报的,我确信它是真实的、可靠的、完整的。申报人签字:DeclarationIdeclarethatthereturnisfilledoutinaccordancewiththeneweditionofPROVISIONALREGULATIONSOFTHEPEOPLESREPUBLICOFCHINAONRESOURCETAXandotherrelevantdocumentsandIpromisethecontentsinthereturnaretrue,reliableandcomplete.Signature:企业盖章 负责人(签字或盖章) 办税人(签字或盖章)Enterprise(Seal) ResponsibleOfficer(SignatureorSeal) PersonforTaxMatters(SignatureorSeal)以下由税务机关填写(ForOfficialUseOnly):收到日期(Dateofreceipt): 审核人(Checkedby): 审核日期(Dateofcheck): 中华人民共和国国家税务总局监制PrintedUndertheSupervisionoftheStateAdministrationofTaxation ofthePeople’sRepublicofChina

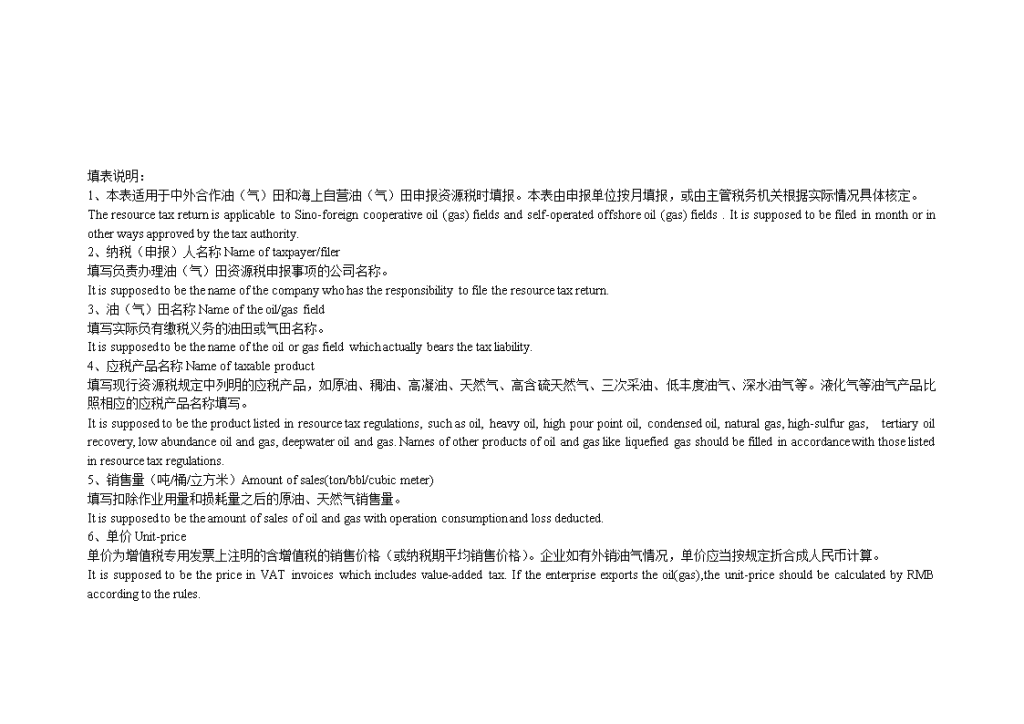

填表说明:1、本表适用于中外合作油(气)田和海上自营油(气)田申报资源税时填报。本表由申报单位按月填报,或由主管税务机关根据实际情况具体核定。TheresourcetaxreturnisapplicabletoSino-foreigncooperativeoil(gas)fieldsandself-operatedoffshoreoil(gas)fields.Itissupposedtobefiledinmonthorinotherwaysapprovedbythetaxauthority.2、纳税(申报)人名称Nameoftaxpayer/filer填写负责办理油(气)田资源税申报事项的公司名称。Itissupposedtobethenameofthecompanywhohastheresponsibilitytofiletheresourcetaxreturn.3、油(气)田名称Nameoftheoil/gasfield填写实际负有缴税义务的油田或气田名称。Itissupposedtobethenameoftheoilorgasfieldwhichactuallybearsthetaxliability.4、应税产品名称Nameoftaxableproduct填写现行资源税规定中列明的应税产品,如原油、稠油、高凝油、天然气、高含硫天然气、三次采油、低丰度油气、深水油气等。液化气等油气产品比照相应的应税产品名称填写。Itissupposedtobetheproductlistedinresourcetaxregulations,suchasoil,heavyoil,highpourpointoil,condensedoil,naturalgas,high-sulfurgas,tertiaryoilrecovery,lowabundanceoilandgas,deepwateroilandgas.Namesofotherproductsofoilandgaslikeliquefiedgasshouldbefilledinaccordancewiththoselistedinresourcetaxregulations.5、销售量(吨/桶/立方米)Amountofsales(ton/bbl/cubicmeter)填写扣除作业用量和损耗量之后的原油、天然气销售量。Itissupposedtobetheamountofsalesofoilandgaswithoperationconsumptionandlossdeducted.6、单价Unit-price单价为增值税专用发票上注明的含增值税的销售价格(或纳税期平均销售价格)。企业如有外销油气情况,单价应当按规定折合成人民币计算。ItissupposedtobethepriceinVATinvoiceswhichincludesvalue-addedtax.Iftheenterpriseexportstheoil(gas),theunit-priceshouldbecalculatedbyRMBaccordingtotherules.

7、销售额(不含增值税)Salesrevenueintotal指增值税专用发票上注明的不含增值税的销售金额。如果销售油气开据的为价税合一的普通发票,采用以下公式换算为不含增值税的销售额:ItissupposedtobethesalesrevenueinVATinvoicesminusvalue-addedtax.Whenitcomestothecommoninvoices,salesrevenueshouldbecalculatedasfollows:不含增值税销售额=含增值税销售额×(1﹣增值税税率)Salesrevenueintotalequalssalesrevenue(includingVAT)multipliedbytheoutcomeofoneminusVATrate.8、减征率Reductionrate减征率=规定税率×减税幅度,如三次采油减税幅度为30%,其减征率为1.5%。Reductionrateequalslegaltaxratemultipliedbytheextentofreduction.Forinstancethereductionrateoftertiaryoilrecoveryis1.5%witha30%reductionextent9、实际征收率EffectiveRT(resourcetax)rate实际征收率=规定税率﹣减征率现行油气资源税规定税率为5%。如三次采油的减征率为1.5%,其实际征收率为:3.5%=5%﹣1.5%Effectiveresourcetaxrateequalslegaltaxrateminusreductionrate.Theresourcelegaltaxrateofoilandgasis5%.Forinstance,theeffectiveresourcetaxrateis3.5%(=5%﹣1.5%)witha1.5%reductionrateoftertiaryoilrecovery.10、销售费用扣除额Salesexpensededuction销售费用扣除额为资源税应入库税额应分担的油气销售费用金额。Itissupposedtobethesalesexpenseattributabletotheresourcetax.'

您可能关注的文档

- 营改增新政策培训增值税纳税申报表ppt培训课件

- 汇算清缴具体方法与纳税申报表填报技巧[甘肃]

- 2014年企业所得税汇算清缴新政解读与新纳税申报表填报技巧

- 浦发银行授信报告增值税纳税申报表.doc

- 企业所得税年度纳税申报表

- iit filing return 个人所得税纳税申报表(中英文版)

- 《中华人民共和国企业所得税月(季)度和年度预缴纳税申报表(b类,2015年版)》及填报说明

- A06443《个人所得税自行纳税申报表(B表)》

- 中华人民共和国企业所得税月(季)度预缴纳税申报表(a

- A06Z01《城镇土地使用税纳税申报表(汇总版)》

- a06624酒及酒精消费税纳税申报表

- 中华人民共和国企业所得税月季度预缴纳税申报表a类

- 《增值税纳税申报表填表说明》

- 深圳最新地税纳税申报表

- 《增值税纳税申报表(适用于一般纳税人)》及其附表填表说明

- 《中华人民共和国企业所得税年度纳税申报表(A …

- 车辆购置税纳税申报表

- 土地增值税纳税申报表