- 271.00 KB

- 2022-04-29 14:24:13 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

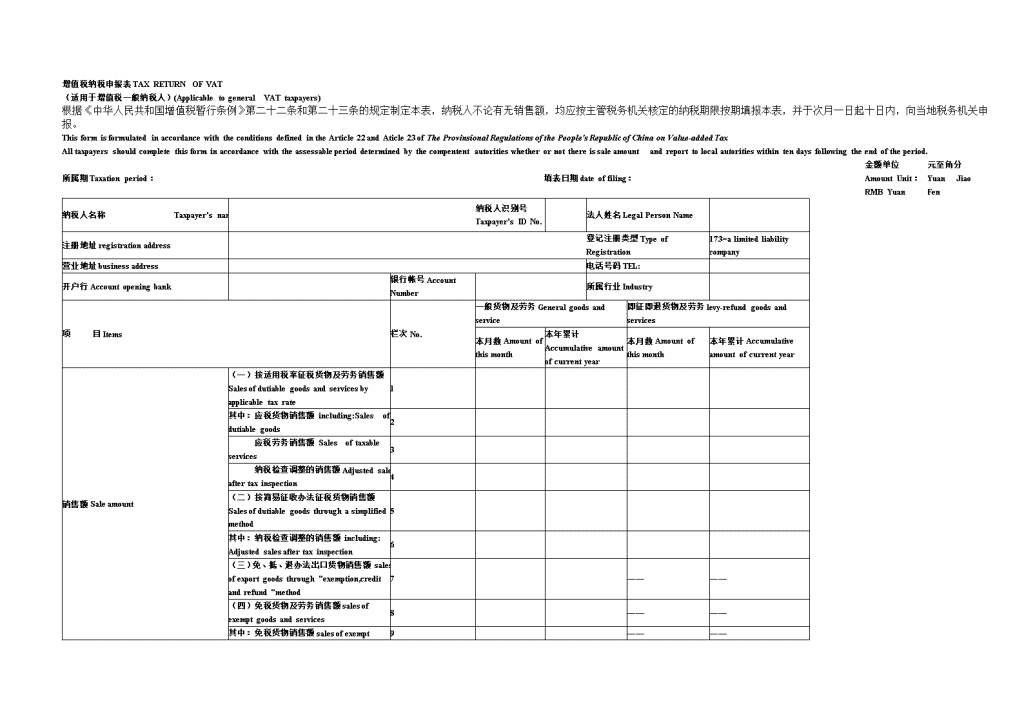

'增值税纳税申报表TAXRETURNOFVAT(适用于增值税一般纳税人)(ApplicabletogeneralVATtaxpayers)根据《中华人民共和国增值税暂行条例》第二十二条和第二十三条的规定制定本表,纳税人不论有无销售额,均应按主管税务机关核定的纳税期限按期填报本表,并于次月一日起十日内,向当地税务机关申报。ThisformisformulatedinaccordancewiththeconditionsdefinedintheArticle22andAticle23ofTheProvinsionalRegulationsofthePeople"sRepublicofChinaonValue-addedTaxAlltaxpayersshouldcompletethisforminaccordancewiththeassessableperioddeterminedbythecompententautoritieswhetherornotthereissaleamountandreporttolocalautoritieswithintendaysfollowingtheendoftheperiod.所属期Taxationperiod:填表日期dateoffiling:金额单位AmountUnit:RMBYuan元至角分YuanJiaoFen纳税人名称Taxpayer"sname 纳税人识别号Taxpayer"sIDNo. 法人姓名LegalPersonName 注册地址registrationaddress 登记注册类型TypeofRegistration173=alimitedliabilitycompany营业地址businessaddress 电话号码TEL: 开户行Accountopeningbank 银行帐号AccountNumber 所属行业Industry 项目Items栏次No.一般货物及劳务Generalgoodsandservice即征即退货物及劳务levy-refundgoodsandservices本月数Amountofthismonth本年累计Accumulativeamountofcurrentyear本月数Amountofthismonth本年累计Accumulativeamountofcurrentyear销售额Saleamount(一)按适用税率征税货物及劳务销售额Salesofdutiablegoodsandservicesbyapplicabletaxrate1 其中:应税货物销售额including:Salesofdutiablegoods2 应税劳务销售额Salesoftaxableservices3 纳税检查调整的销售额Adjustedsalesaftertaxinspection4 (二)按简易征收办法征税货物销售额Salesofdutiablegoodsthroughasimplifiedmethod5 其中:纳税检查调整的销售额including:Adjustedsalesaftertaxinspection6 (三)免、抵、退办法出口货物销售额salesofexportgoodsthrough"exemption,creditandrefund"method7 ————(四)免税货物及劳务销售额salesofexemptgoodsandservices8 ————其中:免税货物销售额salesofexempt9 ————

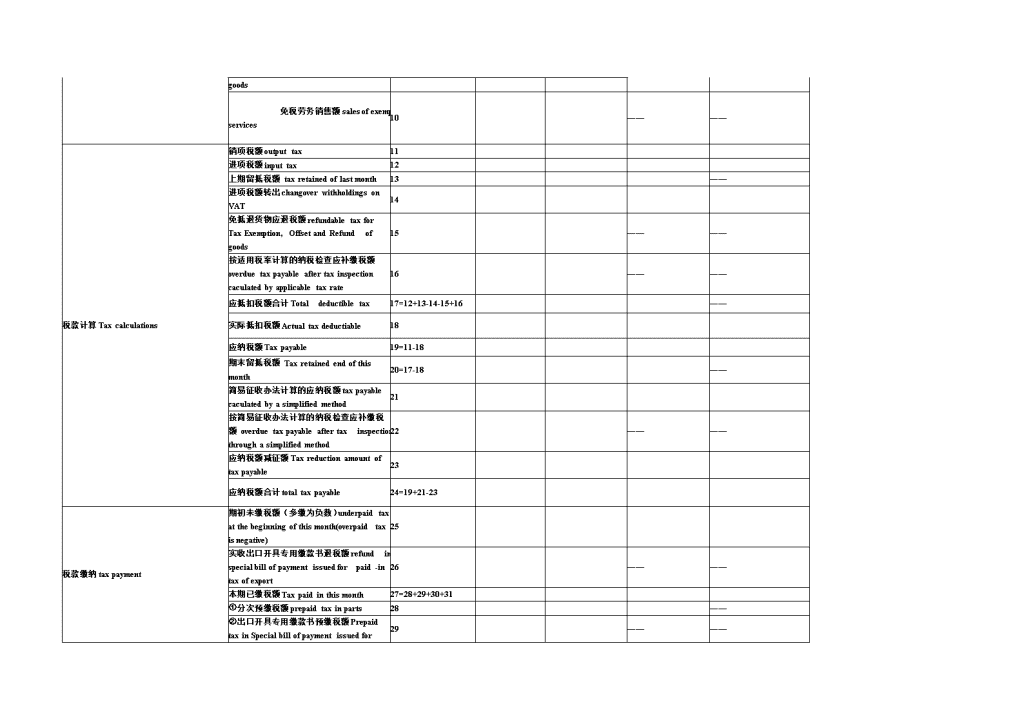

goods免税劳务销售额salesofexemptservices10 ————税款计算Taxcalculations销项税额outputtax11 进项税额inputtax12 上期留抵税额taxretainedoflastmonth13 ——进项税额转出changoverwithholdingsonVAT14 免抵退货物应退税额refundabletaxforTaxExemption,OffsetandRefundofgoods15 ————按适用税率计算的纳税检查应补缴税额overduetaxpayableaftertaxinspectioncaculatedbyapplicabletaxrate16 ————应抵扣税额合计Totaldeductibletax17=12+13-14-15+16 ——实际抵扣税额Actualtaxdeductiable18 应纳税额Taxpayable19=11-18 期末留抵税额Taxretainedendofthismonth20=17-18 ——简易征收办法计算的应纳税额taxpayablecaculatedbyasimplifiedmethod21 按简易征收办法计算的纳税检查应补缴税额overduetaxpayableaftertaxinspectionthroughasimplifiedmethod22 ————应纳税额减征额Taxreductionamountoftaxpayable23 应纳税额合计totaltaxpayable24=19+21-23 税款缴纳taxpayment期初未缴税额(多缴为负数)underpaidtaxatthebeginningofthismonth(overpaidtaxisnegative)25 实收出口开具专用缴款书退税额refundinspecialbillofpaymentissuedforpaid-intaxofexport26 ————本期已缴税额Taxpaidinthismonth27=28+29+30+31 ①分次预缴税额prepaidtaxinparts28 ——②出口开具专用缴款书预缴税额PrepaidtaxinSpecialbillofpaymentissuedfor29 ————

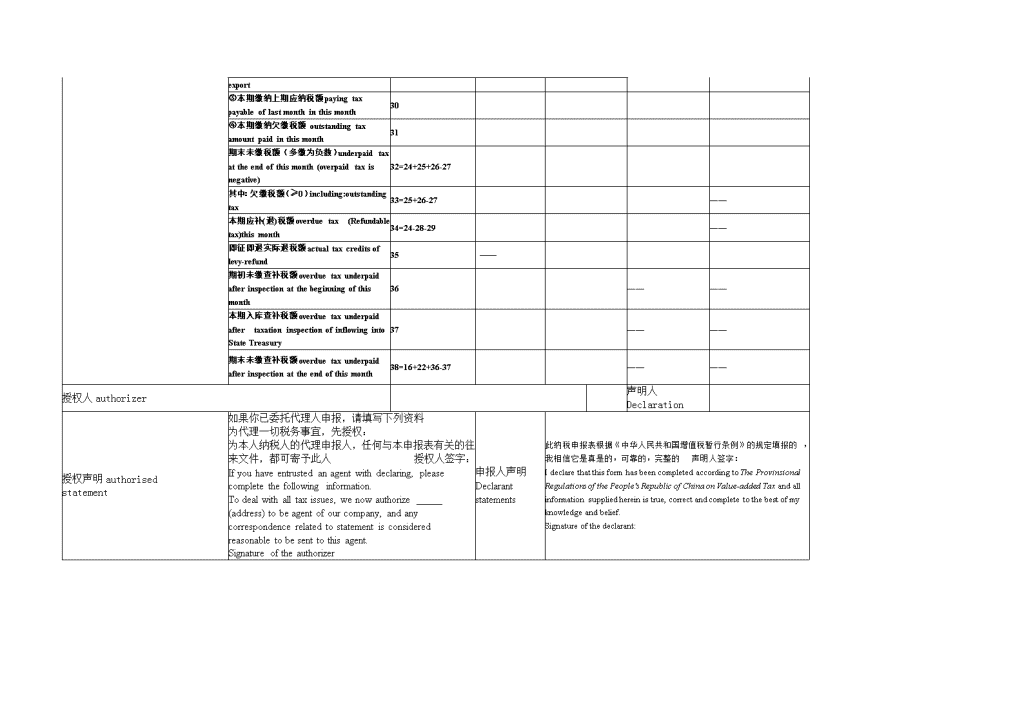

export③本期缴纳上期应纳税额payingtaxpayableoflastmonthinthismonth30 ④本期缴纳欠缴税额outstandingtaxamountpaidinthismonth31 期末未缴税额(多缴为负数)underpaidtaxattheendofthismonth(overpaidtaxisnegative)32=24+25+26-27 其中:欠缴税额(≥0)including:outstandingtax33=25+26-27 ——本期应补(退)税额overduetax(Refundabletax)thismonth34=24-28-29 ——即征即退实际退税额actualtaxcreditsoflevy-refund35—— 期初未缴查补税额overduetaxunderpaidafterinspectionatthebeginningofthismonth36 ————本期入库查补税额overduetaxunderpaidaftertaxationinspectionofinflowingintoStateTreasury37 ————期末未缴查补税额overduetaxunderpaidafterinspectionattheendofthismonth38=16+22+36-37 ————授权人authorizer 声明人Declaration 授权声明authorisedstatement如果你已委托代理人申报,请填写下列资料为代理一切税务事宜,先授权:为本人纳税人的代理申报人,任何与本申报表有关的往来文件,都可寄予此人授权人签字:Ifyouhaveentrustedanagentwithdeclaring,pleasecompletethefollowinginformation.Todealwithalltaxissues,wenowauthorize_____(address)tobeagentofourcompany,andanycorrespondencerelatedtostatementisconsideredreasonabletobesenttothisagent.Signatureoftheauthorizer申报人声明Declarantstatements此纳税申报表根据《中华人民共和国增值税暂行条例》的规定填报的,我相信它是真是的,可靠的,完整的声明人签字:IdeclarethatthisformhasbeencompletedaccordingtoTheProvinsionalRegulationsofthePeople"sRepublicofChinaonValue-addedTaxandallinformationsuppliedhereinistrue,correctandcompletetothebestofmyknowledgeandbelief.Signatureofthedeclarant:'

您可能关注的文档

- a06044金融保险业营业税纳税申报表

- 跨地区经营汇总纳税企业的分支机构纳税申报表

- 中华人民共和国企业所得税纳税申报表

- 上海市纳税申报表

- 附件6 个人所得税自行纳税申报表(B表)

- 企业所得税年度纳税申报表

- 中华人民共和国企业所得税年度纳税申报表及附表填报说明

- 中华人民共和国企业所得税月(季)度预缴和年度纳税申报表

- 增值税纳税申报表(适用小规模纳税人)

- 增值税纳税申报表

- 企业所得税预缴纳税申报表

- 酒及酒精消费税纳税申报表

- a06109《房产税纳税申报表》

- 财产和行为税各税种纳税申报表样表.

- 增值税纳税申报表填表说明

- 增值税纳税申报表(适用于一般纳税人)

- 《中华人民共和国非居民企业所得税季度纳税申报表(适用于

- 企业所得税月(季)度预缴纳税申报表(a类,2015年版,深圳地税版)