- 1.12 MB

- 2022-04-29 14:40:03 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

'《学科优质课堂中教学技艺运用的实验2

OverviewofERMERMisajourney,notaonetimeeventERMisnotjustcompliance,itneedstobeembeddedintheculturetobesuccessfulERMstartsatthetopERMtakesthecommitmentofthemanagementteamERMtakestimetodevelop

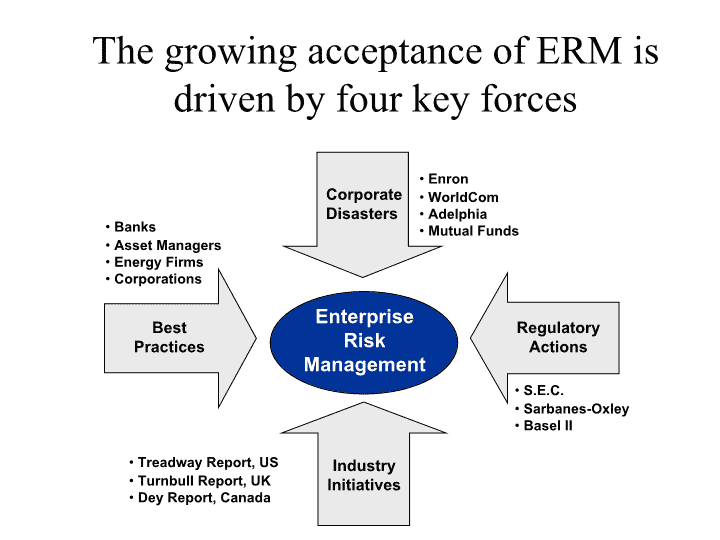

ThegrowingacceptanceofERMisdrivenbyfourkeyforcesCorporateDisastersEnronWorldComAdelphiaMutualFundsIndustry

InitiativesTreadwayReport,USTurnbullReport,UKDeyReport,CanadaBestPracticesBanksAssetManagersEnergyFirmsCorporationsRegulatory

ActionsS.E.C.Sarbanes-OxleyBaselIIEnterprise

Risk

Management

RatingAgencyandInsuranceCompanyConsiderationsMoody’sandStandardandPoors’nowincorporateriskmanagementassessmentintocreditratingsS&PCommentarybankingandinsurancesectors2yearsagoReportoninsuranceindustrycomingoutsoonLookingattradingriskfortheenergysectorConsideringotherindustries“Companieswhomanageriskeffectivelyshouldreceive“credit”intheratingprocess”Insurancecompanies(D&Ounderwriters)considerratingagencyopinionsUnderwriterslookfavorablytowardcompanieswhoarefocusedonmanagingrisk

OneFrameworkforERMCommitteeofSponsoringOrganizationsoftheTreadwayCommission(COSO)PublishedEnterpriseRiskManagement-IntegratedFrameworkin2004COSOhasdefinedERMas…Aprocess,effectedbyanentity’sboardofdirectors,managementandotherpersonnel,appliedinstrategysettingandacrosstheenterprise,designedtoidentifypotentialeventsthatmayaffecttheentity,andmanagerisktobewithinitsappetite,toprovidereasonableassuranceregardingtheachievementofentityobjectives.

TraditionalriskmanagementSixstepprocessRiskidentificationRiskanalysisDevelopmentofalternativetechniquestotreatrisksSelectionofbestrisk-treatmenttechniquesImplementationofselectedtechniquesEvaluationandmonitorofeffectivenessofriskmanagement

TenkeyquestionstoconsiderWhatisourappetiteforrisk?(capacityandpropensity)Doweknowwhatourrisksare?Doweknowhowthoserisksrelatetooneanother?Whowithinourcompany“owns”thoserisks?Canwemeasurethoserisks?Haveweevaluatednon-traditionalrisks?Doeseveryoneatourcompanyunderstandtheirroleinmanagingrisk?Iseffectiveriskmanagementlinkedtoperformanceevaluations?Isriskconsideredinallfacetsofdecisionmaking?Doesourcompanycontinuallylookforwaystooptimizeriskstrategy?

ERMExpandsTraditionalRiskManagementMorefullyintegratesriskmanagementintotheorganization’sstructureERMisaninteractiveprocessnotareactiveprocess

EstablishanERMframework–policies,processes,andsystemsManageriskinterdependenciesandaggregationsProviderisktransparencytokeystakeholdersEnsurecompanypracticesmeetorexceedregulatoryrequirementsBalancebusinessandriskrequirements,andavoid“irrationalexuberance”Optimizerisk/returnbyintegratingERMintostrategicplanningandday-to-daybusinessprocessesAttract,retain,anddeveloptalentedriskprofessionalsTheroleofachiefriskofficer(CRO)

AnERMframeworkshouldencompasssevenkeybuildingblocks2.LineManagementBusinessstrategyalignment3.PortfolioManagementThinkandactlikea“fundmanager”4.RiskTransferTransferoutconcentratedorinefficientrisks5.RiskAnalyticsDevelopadvanced

analyticaltools6.DataandTechnologyResourcesIntegratedataand

systemcapabilities7.StakeholdersManagementImproverisktransparencyforkeystakeholders1.CorporateGovernanceEstablishtop-downriskmanagement

AnERMdashboardshouldaddressfivekeyquestionsforseniormanagementAreanyofourstrategic,business,andfinancialobjectivesatrisk?Areweincompliancewithpolicies,limits,laws,andregulations?Whatriskincidentshavebeenescalatedbyourriskfunctionsandbusinessunits?Whatkeyriskindicatorsandtrendsthatrequireimmediateattention?Whataretheriskassessmentsthatweshouldreview?

Casestudy:$1trillionof

assetsundermanagementPrivatecompanyDecentralizedbusinesscultureBackground3-YearERMProgramOrganizedGlobalRiskForumImplementedannualGlobalRiskReviewAutomatedlossaccountingDevelopedERMframeworkImplementedintranet-basedGlobalRiskMISExperiencedsignificantreductioninlossratio

RiskMetricsRiskEventLogEventLossRootCausesControlsNeededEducationNewassociatesManagementBusiness/OperationalprocessesBestpracticesLessonslearnedGoalMAPActualLossExperience85%DeclineBasicriskmanagementprocessescanleadtosignificantimprovements

EconomiccapitalrepresentsacommoncurrencyforriskCreditRiskEarningsvolatilityduetovariationincreditlossesMarketRiskEarningsvolatilityduetomarketpricemovementsOperationalRiskEarningsvolatilityduetochangesinoperatingeconomics(e.g.volume,marginsorcosts)orone-offeventsCreditRiskMarketRiskOperationalRiskProbabilityChangeinValueEnterprise-wideRisk

Casestudy:NewcapitalmarketsbusinessTradershiredfromforeignbankAggressivebusinessandgrowthtargetsBackground2-YearERMProgramEstablishedriskpoliciesandsystemsInstilledriskcultureSurvived“Kidder”disasterCaptured25%marketsharewithzeropolicyviolationsRecognizedasbestpractice

EngagedseniormanagementandboardofdirectorsEstablishedpolicies,systems,andprocesses,supportedbyastrongriskcultureClearlydefinedriskappetitewithrespecttorisklimitsandbusinessboundariesRobustriskanalyticsforintra-andinter-riskmeasurement,summarizedinan“ERMdashboard”Risk-returnmanagementviaintegrationofERMintostrategicplanning,businessprocesses,performancemeasurement,andincentivecompensationHallmarksofsuccessinERMatGE

ERMMetricsYoucannotmanagewhatyoucannotmeasureGoalistomeasureriskonacommonbasis

FinancialPerformanceMeasuresReturnonEquity(ROE)OperatingEarningsEarningsbeforeinterest,dividends,taxes,depreciationandamortization(EBITDA)CashFlowReturnonInvestments(CFROI)WeightedAverageCostofCapital(WACC)EconomicValueAdded(EVA)

FinancialRiskMetricsReturnonCapital(FinancialServicesIndustry)Risk-adjustedreturnoncapital(RAROC)Returnonrisk-adjustedcapital(RORAC)Risk-adjustedreturnonrisk-adjustedcapital(RARORAC)EconomicIncomeCreatedRisk-adjustedreturn–(Hurdleratexeconomiccapital)ShareholderValueShareholdervalue(SHV)DiscountedvalueofcashflowsShareholdervalueadded(SVA)DiscountedvalueofEVA(EconomicValueAdded)

FinancialRiskManagementMetricsInterestRateSensitivityMeasuresDurationandconvexityInterestRateModelsValue-at-Risk(VaR)ParametricMonteCarlosimulationHistoricalsimulationAsset/LiabilityManagement(ALM)

ValueatRisk-ADefinitionValueatriskisastatisticalmeasureofpossibleportfoliolossesApercentileofthedistributionofoutcomesValueatRisk(VaR)istheamountoflossthataportfoliowillexperienceoverasetperiodoftimewithaspecifiedprobabilityThus,VaRdependsonsometimehorizonandadesiredlevelofconfidence

ValueatRisk-AnExampleLet’susea5%probabilityandaone-dayholdingperiodVaRistheonedaylossthatwillbeexceededonly5%ofthetimeIt’sthetailofthereturndistributionIntheexample,theVaRisabout$60,000

First-IdentifytheMarketFactorsTherearethreemethodstocalculateVaR,butthefirststepistoidentifythe“marketfactors”MarketfactorsarethevariablesthatimpactthevalueoftheportfolioStockprices,exchangerates,interestrates,etc.ThedifferentapproachestoVaRarebasedonhowthemarketfactorsaremodeled

MethodsofCalculatingVaRHistoricalsimulationApplyrecentexperiencetocurrentportfolioVariance-covariancemethodAssumeanormaldistributionandusethestatisticalpropertiestofindVaRMonteCarloSimulationGeneratescenariostodeterminechangesinportfoliovalue

Basedonthese10lowestreturnsoutof100ofasimulationofassetvalue,whatisthe95%VaR?A)19,536,917B)13,558,569C)11,964,744D)9,975,605E)NoneoftheaboveChangeinAssetValue(19,536,917)(13,558,569)(13,037,674)(12,034,629)(11,964,744)(9,975,605)(8,006,458)(7,776,690)(6,790,814)(6,760,278)

CurrentStateofFinancialRiskManagementModelingisusedextensivelyinmeasuringmarketriskInterestratesensitivitymeasuresdependoncashflowmodelsandtermstructuremodelsValue-at-RiskmeasuresalsodependonmodelsDon’tbefooledbyindicatedprecisionofmeasuresUnderstandthemodelsunderlyingthecalculations

OperationalandStrategicRiskAnalyticsAnalyticmethodsareprimitiveTop-DownApproachesAnalogsRemoveidentifiablerisksfirstRemainingriskisclassifiedasoperationalriskHistoricallossdataBottom-UpApproachesSelfassessmentCashflowmodel

SolvencyRelatedRiskMeasuresProbabilityofRuinShortfallRiskValue-at-Risk(VaR)ExpectedPolicyholderDeficit(EPD)orEconomicCostofRuin(ECOR)TailValueatRisk(TailVaR)orTailConditionalExpectation(TCE)TailEvents

PerformanceRelatedRiskMeasuresVarianceStandardDeviationSemi-varianceandDownsideStandardDeviationBelow-target-risk(BTW)

ConclusionThereisastandardapproachfordealingwitheachtypeofriskEachareahasitsownterminologyandtechniquesTheERMchallengeistocombinethesedifferentapproachesintoacommonmethodthatcandealwithriskinanintegratedmannerThefirststepistounderstandthedifferentapproaches

AcknowledgementsFrankStrenk,LocktonCompaniesJamesLamMarkVonnahme,DepartmentofFinance,UofI

What’sNext?Thursday,April26Case3Tuesday,May1CoursesummaryandreviewforthefinalexamFinalExamBoth8:30amand10amsectionsFriday,May4,20078-11am120ArchitectureBuildingConflictexam8-11amMonday,May7–locationTBA

w*t$qYnVjSgPdLaI7F3C0y)v&s#pXmUiRfNcK9H5E2B+x(u$rZoWkThQeMbJ7G4D1z-w*t!qYmVjSgOdLaI6F3C0y)v%s#pXlUiRfNcK8H5E2A+x(u$rZnWkThPeMbJ7G4C1z-w&t!qYmVjRgOdL9I6F3B0y(v%s#oXlUiQfNbK8H5D2A+x*u$rZnWkShPeMaJ7G4C1z)w&t!pYmVjRgOcL9I6E3B0y(v%r#oXlTiQfNbK8G5D2A-x*u$qZnVkShPdMaJ7F4C0z)w&s!pYmUjRgOcL9H6E3B+y(v%r#oWlTiQeNbK8G5D1A-x*t$qZnVkSgPdMaI7F4C0z)v&s!pXmUjRfOcK9H6E2B+y(u%rZoWlThQeNbJ8G4D1A-w*t$qYnVkSgPdLaI7F3C0z)v&s#pXmUiRfOcK9H5E2B+x(u%rZoWkThQeMbJ8G4D1z-w*t!qYnVjSgOdLaI6F3C0y)v%s#pXlUiRfNcK9H5E2A+x(u$rZoWkThPeMbJ7G4D1z-w&t!qYmVjSgOdL9I6F3B0y)v%s#oXlUiQfNcK8H5D2A+x*u$rZnWkShPeMaJ7G4C1z)w&t!pYmVjRgOdL9I6E3B0y(v%s#oXlTiQfNbK8H5D2A-x*u$qZnWkShPdMaJ7F4C1z)w&s!pYmUjRgOcL9H6E3B+y(v%r#oWlTiQeNbK8G5D2A-x*t$qZnVkShPdMaI7F4C0z)w&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-w*t$qYnVkSgPdLaI7F3C0z)v&s!pXmUiRfOcK9H6Ex*t$qZnVkShPdMaI7F4C0z)w&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-w*t$qYnVkSgPdMaI7F3C0z)v&s!pXmUiRfOcK9H6E2B+x(u%rZoWlThQeMbJ8G4D1A-w*t!qYnVjSgPdLaI6F3C0y)v&s#pXlUiRfNcK9H5E2B+x(u$rZoWkThQeMbJ7G4D1z-w*t!qYmVjSgOdLaI6F3B0y)v%s#pXlUiQfNcK8H5E2A+x*u$rZnWkThPeMaJ7G4C1z-w&t!pYmVjRgOdL9I6F3B0y(v%s#oXlUiQfNbK8H5D2A+x*u$qZnWkShPeMaJ7F4C1z)w&t!pYmUjRgOcL9I6E3B+y(v%r#oXlTiQeNbK8G5D2A-x*u$qZnVkShPdMaJ7F4C0z)w&s!pYmUjRfOcL9H6E3B+y(u%r#oWlTiQeNbJ8G5D1A-x*t$qYnVkSgPdMaI7F3C0z)v&s!pXmUjRfOcK9H6E2B+y(u%rZoWlThQeNbJ8G4D1A-w*t$qYnVjSgPdLaI7F3C0y)v&s#pXmUiRfNcK9H5E2B+x(u$rZoWkThQeMbJ7G4D1z-w*t!qYnVjSgOdLaI6F3C0y)v%s#pXlUiRfNcK8H5E2A+x(u$rZnWkThPeMbJ7G4C1z-w&t!qYmVjRgOdL9I6F3B0y(v%s#oXlUiQfNcK8H5D2A+x*u$rZnWkShPeMaJ7G4C1z)w&t!pYmVjRgOcL9I6E3B0y(v%r#oXlTiQfNbK8G5D2A-x*u$qZnVkShPdMaJ7F4C1z)w&s!lUiQfNcK8H5D2A+x*u$rZnWkShPeMaJ7G4C1z)w&t!pYmVjRgOcL9I6E3B0y(v%r#oXlTiQfNbK8G5D2A-x*u$qZnWkShPdMaJ7F4C1z)w&s!pYmUjRgOcL9H6E3B+y(v%r#oWlTiQeNbK8G5D1A-x*t$qZnVkSgPdMaI7F4C0z)v&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-w*t$qYnVkSgPdLaI7F3C0z)v&s#pXmUiRfOcK9H5E2B+x(u%rZoWkThQeMbJ8G4D1z-w*t!qYnVjSgPdLaI6F3C0y)v&s#pXlUiRfNcK9H5E2A+x(u$rZoWkThPeMbJ7G4D1z-w&t!qYmVjSgOdL9I6F3B0y)v%s#oXlUiQfNcK8H5E2A+x*u$rZnWkThPeMaJ7G4C1z-w&t!pYmVjRgOdL9I6E3B0y(v%s#oXlTiQfNbK8H5D2A-x*u$qZnWkShPdMaJ7F4C1z)w&s!pYmUjRgOcL9I6E3B+y(v%r#oXlTiQeNbK8G5D2A-x*t$qZnVkShPdMaI7F4C0z)w&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-x*t$qYnVkSgPdMaI7F3C0z)v&s!pXmUiRfOcK9H6E2B+x(u%rZoWlThQeMbJ8G4D1A-w*t!qYnVjSgPdLaI6F3C0y)v&s#pXmUiRfNcK9H5E2B+x(u$rZoWkThQeMbJ7G4D1z-w*t!qYmVjSgOdLaI6F3B0y)v%s#pXlUiQfNcKD1A-w*t!qYnVjSgPdLaI7F3C0y)v&s#pXmUiRfNcK9H5E2B+x(u$rZoWkThQeMbJ7G4D1z-w*t!qYmVjSgOdLaI6F3B0y)v%s#pXlUiQfNcK8H5E2A+x(u$rZnWkThPeMbJ7G4C1z-w&t!qYmVjRgOdL9I6F3B0y(v%s#oXlUiQfNbK8H5D2A+x*u$qZnWkShPeMaJ7F4C1z)w&t!pYmUjRgOcL9I6E3B0y(v%r#oXlTiQfNbK8G5D2A-x*u$qZnVkShPdMaJ7F4C0z)w&s!pYmUjRfOcL9H6E3B+y(u%r#oWlTiQeNbJ8G5D1A-x*t$qZnVkSgPdMaI7F4C0z)v&s!pXmUjRfOcK9H6E2B+y(u%rZoWlThQeNbJ8G4D1A-w*t$mUjRfOcL9H6E3B+y(v%r#oWlTiQeNbK8G5D1A-x*t$qZnVkSgPdMaI7F4C0z)v&s!pXmUjRfOcK9H6E2B+y(u%rZoWlThQeNbJ8G4D1A-w*t$qYnVjSgPdLaI7F3C0z)v&s#pXmUiRfOcK9H5E2B+x(u%rZoWkThQeMbJ8G4D1z-w*t!qYnVjSgOdLaI6F3C0y)v%s#pXlUiRfNcK8H5E2A+x(u$rZoWkThPeMbJ7G4D1z-w&t!qYmVjSgOdL9I6F3B0y)v%s#oXlUiQfNcK8H5D2A+x*u$rZnWkShPeMaJ7G4C1z)w&t!pYmVjRgOcL9I6E3B0y(v%s#oXlTiQfNbK8H5D2A-x*u$qZnWkShPdMaJ7F4C1z)w&s!pYmUjRgOcL9H6E3B+y(v%r#oWlTiQeNbK8G5D1A-x*t$qZnVkShPdMaI7F4C0z)w&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-w*t$qYnVkSgPdLaI7F3C0z)v&s#pXmUiRfOcK9H6E2B+x(u%rZoWlThQeMbJ8G0z)w&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-w*t$qYnVkSgPdLaI7F3C0z)v&s!pXmUiRfOcK9H6E2B+x(u%rZoWlThQeMbJ8G4D1A-w*t!qYnVjSgPdLaI6F3C0y)v&s#pXlUiRfNcK9H5E2A+x(u$rZoWkThQeMbJ7G4D1z-w*t!qYmVjSgOdLaI6F3B0y)v%s#pXlUiQfNcK8H5E2A+x*u$rZnWkThPeMaJ7G4C1z-w&t!pYmVjRgOdL9I6E3B0y(v%s#oXlUiQfNbK8H5D2A+x*u$qZnWkShPeMaJ7F4C1z)w&t!pYmUjRgOcL9I6E3B+y(v%r#oXlTiQeNbK8G5D2A-x*t$qZnVkShPdMaJ7F4C0z)w&s!piQfNbK8H5D2A+x*u$qZnWkShPeMaJ7F4C1z)w&t!pYmUjRgOcL9I6E3B+y(v%r#oXlTiQeNbK8G5D2A-x*u$qZnVkShPdMaJ7F4C0z)w&s!pYmUjRfOcL9H6E3B+y(u%r#oWlTiQeNbJ8G5D1A-x*t$qYnVkSgPdMaI7F3C0z)v&s!pXmUjRfOcK9H6E2B+y(u%rZoWlThQeNbJ8G4D1A-w*t$qYnVjSgPdLaI7F3C0y)v&s#pXmUiRfNcK9H5E2B+x(u$rZoWkThQeMbJ8G4D1z-w*t!qYnVjSgOdLaI6F3C0y)v%s#pXlUiRfNcK8H5E2A+x(u$rZnWkThPeMbJ7G4C1z-w&t!qYmVjRgOdL9I6F3B0y(v%s#oXlUiQfNcK8H5D2A+x*u$rZnWkShPeMaJ7G4C1z)w&t!pYmVjRgOcL9I6E3B0y(v%r#oXlTiQfNbK8G5D2A-x*u$qZnSgOdL9I6F3B0y)v%s#oXlUiQfNcK8H5D2A+x*u$rZnWkShPeMaJ7G4C1z)w&t!pYmVjRgOcL9I6E3B0y(v%r#oXlTiQfNbK8G5D2A-x*u$qZnWkShPdMaJ7F4C1z)w&s!pYmUjRgOcL9H6E3B+y(v%r#oWlTiQeNbK8G5D1A-x*t$qZnVkSgPdMaI7F4C0z)v&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-w*t$qYnVkSgPdLaI7F3C0z)v&s#pXmUiRfOcK9H5E2Bt$qZnVkSgPdMaI7F4C0z)w&s!pXmUjRfOcL9H6E2B+y(u%r#oWlThQeNbJ8G5D1A-w*t$qYnVkSgPdLaI7F3C0z)v&s#pXmUiRfOcK9H5E2B+x(u%rZoWlThQeMbJ8G4D1A-w*t!qYnVjSgPdLaI6F3C0y)v&s#pXlUiRfNcK9H5E2A+x(u$rZoWkThPeMbJ7G4D1z-w&t!qYmVjSgOdLaI6F3B0y)v%s#pXlUiQfNcK8H5E2A+x*u$rZnWkThPeMaJ7G4C1z-w&t!pYmVjRgOdL9I6E3B0y(v%s#oXlTiQfNbK8H5D2A-x*u$qZnWkShPeMaJ7F4C1z)w&t!pYmUjRgOcL9I6E3B+y(v%r#oXlTiQeNbK8G5D2A-x*t$qZnVkShPdMaI7F4C0z)w&s!pXmUjRfOcL9H6E3B+y(u%r#oWlTiQeJ7F4C1z)w&t!pYmUjRgOcL9I6E3B+y(v%r#oXlTiQeNbK8G5D2A-x*t$qZnVkShPdMaI7F4C0z)w&s!pYmUjRfOcL9H6E3B+y(u%r#oWlTiQeNbJ8G5D1A-x*t$qYnVkSgPdMaI7F3C0z)v&s!pXmUi

如何在作文中写好心理描写巧写作文之三:

何谓心理活动?在生活中,我们每当遇到一些事情的时候,心理总会产生一些想法和做法,这就是心理活动。

结合人物的语言行动描写,把人物是怎么想的写清楚,这就是——心理描写

心理描写的方法方法和技巧

一、直接刻画、交待人物心理一般常用“他感到……”、“他觉得……”、“他认为……”、“他思索着……”、“他想起……”等带有标志性的词语来表达。

例1:她(桑娜)忐忑不安地想:“他会说些什么呢?这是闹着玩的吗?自己的五个孩子已经够他受的了……是他来啦?……不,还没来!为什么把他们抱过来啊?……他会揍我的!那也活该,我自作自受。嗯,揍我一顿也好!——《穷人》

二、通过想象描写,表现人物的内心世界这种心理描写方法,常常借助梦境、幻觉,以想象来表现人物内心世界。

例2:《买火柴的小女孩》一文,描写小女孩在饥寒交迫的情况下,擦然一根根火柴产生了幻觉,展现初一幅幅美丽的幻想世界:点燃第一根火柴,仿佛自己坐在大火炉面前;第二根,仿佛看见了烤鹅;第三根,仿佛看到了圣诞树;第四根,仿佛看到了奶奶;点燃一整把火柴,仿佛奶奶把她带到光明快乐的地方去了。

三、通过动作、表情反映人物心理人物的一举一动,都是人物内心世界的外在体现。刻画得好,往往能从侧面表现人物的心理活动。

例3:叙利奥忽然觉得有人用两只发抖的手抱住了他的头,不觉‘呀’的一声叫了起来。——《小抄写员》例4:他(韩麦尔先生)脸色惨白,头靠着墙壁,话也不说……——《最后一课》

四、通过环境描写侧面烘托。一个人在不同的心情时看相同的景物,会产生不同的感受,因为人对使自己心灵产生感应的事物特别敏感,因此人的眼睛能根据自己的心情选择景物,并伴随着强烈的主观感受。

例5:冷风吹进船舱中,呜呜的响,从缝隙向外一望,苍黄的天底下,远近横着几个萧索的荒村,没有一些活气。——鲁迅《故乡》

一、直接刻画、交待人物心理二、通过想象描写,表现人物的内心世界三、通过动作、表情反映人物心理心理描写的方法:}}直接描写间接描写四、通过环境描写侧面烘托。

例6:《发试卷》我不停地在心里念叨:“阿弥陀佛,上帝啊,保佑我吧!我再也不上网,不看电视,不打游戏了。唉!都有怪我自己,老想着打游戏,考试前一天还趁父母不在家偷看了一个小时的电视。老师啊,发发慈悲,手下留情,我以后上课一定好好听讲,千万别让我不及格啊!”——直接刻画,交代心理

我好象看见满试卷鲜红的叉组成一张巨大的网向卷来,使我不得动弹,不能呼吸。我又仿佛看到了老师满面的怒容,仿佛听到了父母悲伤的叹息声和旁人的嘲笑声。——通过幻觉表现内心世界

天阴沉沉的,不时刮来阵阵冷风。风刮到我身上,我就不由自主地打颤。教室里静悄悄的,只听见“沙沙”的发试卷的声音,“哗啦!”我的心随之猛跳了一下,一个同学不小心把书碰到了地下。同桌的试卷已发下来了,72分,看着同桌哭丧的脸,我不由得心里直打鼓。——通过环境描写侧面烘托

我用有点颤抖的手去掀试卷,一个鲜红的“4”字映入我的眼帘,我的手一抖,试卷又合上了。我一咬牙,把手伸到试卷底下,用力一翻,随着“啪”的一声,我看到了我的分数──48,可怜的“48”,我“唉”的一声便瘫在了桌上。——通过动作、表情反映人物心理'

您可能关注的文档

- 最新《子路、曾皙、冉有、公西华侍坐》ppt课件课件PPT.ppt

- 最新《嫦娥奔月》精品课件(活动版)课件PPT.ppt

- 最新《娜塔莎》12概要课件PPT.ppt

- 最新《妈妈的好帮手》课件.课件PPT.ppt

- 最新《季氏将伐颛臾》精品课件PPT课件.ppt

- 最新《孙中山的三民主义》优质课件课件PPT.ppt

- 最新《学会记事》写作课件PPT课件.ppt

- 最新《学会和父母沟通》心理健康课课件PPT课件.ppt

- 最新《学习雷锋》主题班会PPT课件PPT课件幻灯片.ppt

- 最新《学生实验:探究——电流与电压、电阻的关系》优教课件PPT课件.ppt

- 最新《实数课件PPT》PPT课件.ppt

- 最新《实数课件PPT》课件ppt.ppt

- 最新《寻隐者不遇》PPT课件课件PPT.ppt

- 最新《对数的概念》课件1.1课件PPT.ppt

- 最新《寡人之于国也》优秀课件(1)课件PPT.ppt

- 最新《寒风吹彻》教研课课件PPT.ppt

- 最新《密度与社会生活》课件PPT.ppt

- 最新《宾表语从句》PPT课件课件PPT.ppt